Getting to Grips with FRS 102

Learn detail about the concepts and principles, key definitions and how the terminology is changing in FRS 102, and find out what things will be key to successful implementation of the new practices.

This course is not currently available

This course will enable you to

- Understand what FRS 102 is, its concepts and principles

- Find out about the differences from previous GAAP

- Understand the key issues when accounting for assets

- Find out how FRS 102 affects employee benefits and deferred tax

- Understand how the transition to FRS 102 will affect accounting for financial instruments

About the course

As you prepare to report under the UK and RoI Generally Accepted Accounting Practice (GAAP), understanding FRS 102 and its implications will be key to successful implementation of the new practices.

This course looks in detail at FRS 102, its concepts and principles, key definitions and how the terminology is changing. In particular, the course looks at the recognition and measurement of assets and liabilities, how to account for employee benefits as well as exploring the main differences between previous GAAP and the requirements of FRS 102.

Look inside

Contents

- Concepts, principles, and presentation

- What is the scope of FRS 102, and what are its concepts and principles?

- What are the contents of a complete set of financial statements, and what are the significant differences from previous GAAP?

- What is the FRS 102 reduced disclosure framework?

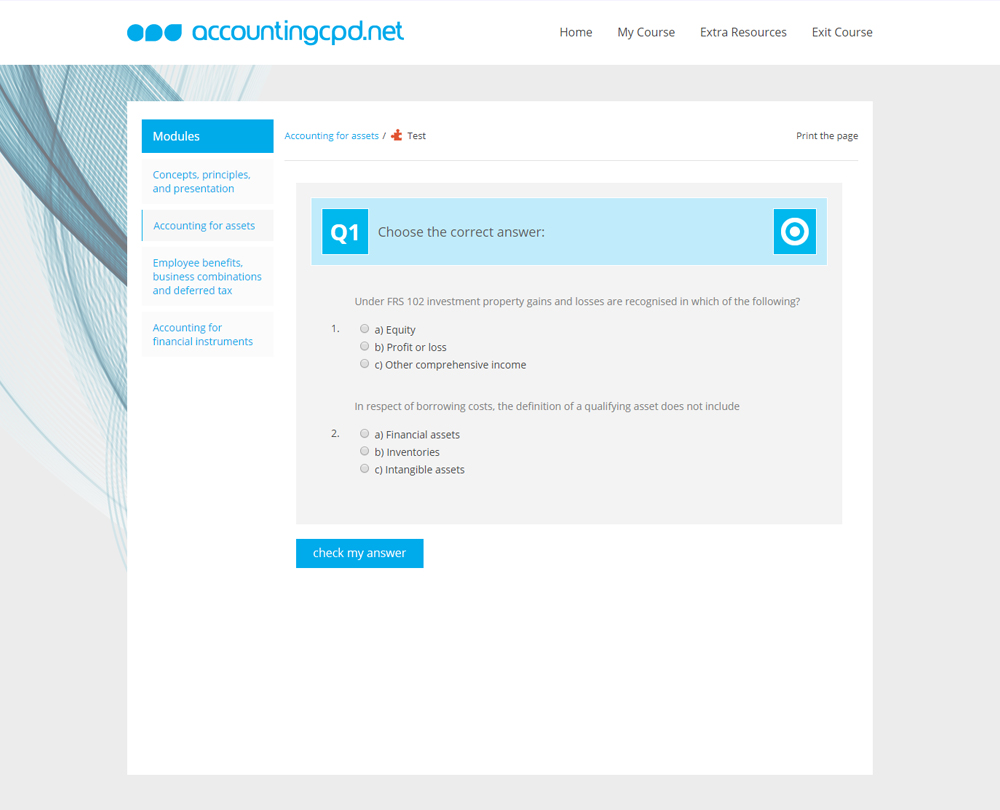

- Accounting for assets

- What are the main matters to be considered in relation to property, plant and equipment?

- How is investment property accounted for under FRS 102?

- What are the transitional issues in relation to intangible assets other than goodwill?

- Are leases and borrowing costs accounted for differently under FRS 102?

- Employee benefits, business combinations and deferred tax

- How will employee benefits be accounted for under FRS 102?

- What are the changes in relation to business combinations and goodwill?

- What are the requirements for accounting for deferred tax under FRS 102?

- Accounting for financial instruments

- Why is accounting for financial instruments likely to represent a significant issue on transition to FRS 102?

- How are financial instruments classified?

- How are basic financial instruments measured?

- What are the requirements in relation to non-basic financial instruments?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.