Introduction to Financial Modelling

Explore why and how financial models are used by businesses, and the standards (FAST) that exist, and look in detail at how models are set-up, how concept diagrams can be useful and the different considerations that feed into building calculations.

This course is not currently available

This course will enable you to

- Understand what constitutes a financial model, why businesses use models and some of the inherent limitations

- Recognise what standards are, why they are used and examples of commonly accepted standards

- Establish how to set up and structure input sheets, working sheets and output sheets

- Understand how to make concept diagrams

- Learn the best practice calculation block structure and key excel functions that are commonly used

About the course

When done well, financial models are powerful tools that can be used to help organisations make good business decisions. But building robust and relevant financial models is not always easy.

This course provides a solid introduction to financial modelling - exploring why and how they are used by businesses, and how the standards (FAST) that exist can ensure that the financial models you develop work for your businesses. It also looks in detail at how the models are set up, how concept diagrams can be useful and the different considerations that feed into building calculations.

Look inside

Contents

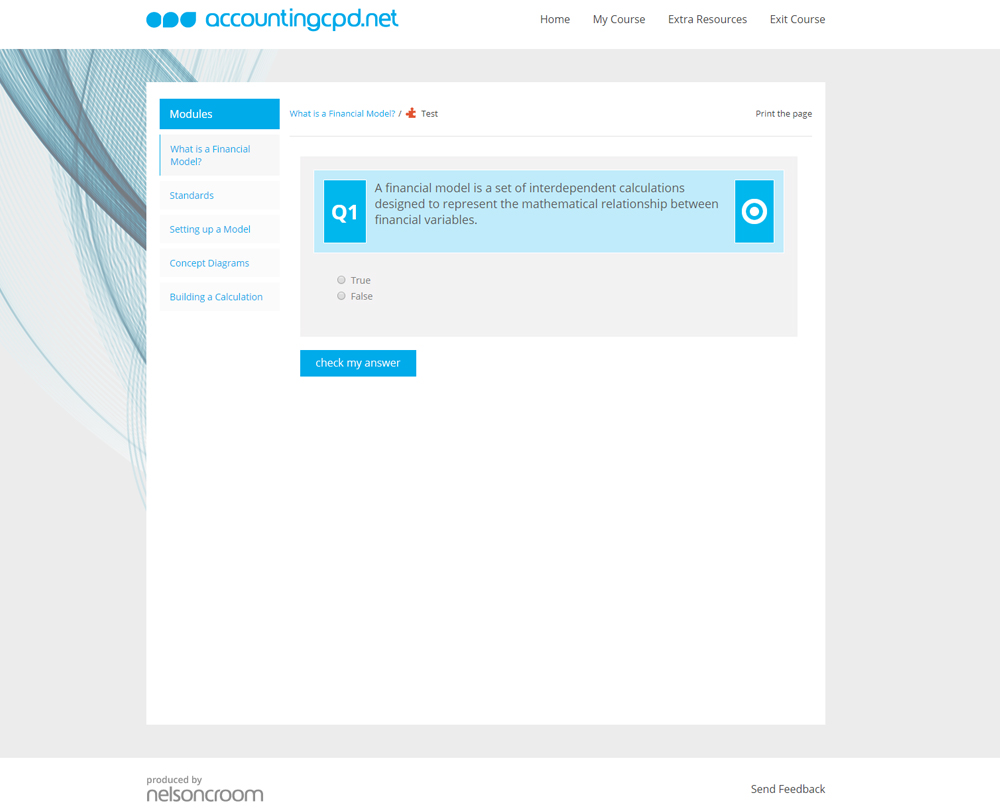

- What is a Financial Model?

- What is a financial model?

- Why do businesses use models?

- How do we do financial modelling?

- What do we use models for?

- What skills do I need to do financial modelling?

- Where can things go wrong?

- Standards

- What are standards?

- Why do we use standards?

- When should I use a standard?

- Why is FAST significant?

- What are the key characteristics of FAST?

- Setting up a Model

- How do I set up a model?

- Why have a standard structure for each model?

- What goes on the input sheet?

- What goes on the workings sheet?

- What goes on the output sheet?

- What is the standard recommended format for each sheet?

- Concept Diagrams

- What are concept diagrams?

- Why use concept diagrams?

- What am I trying to model?

- When should I use concept diagrams?

- How are concept diagrams used?

- Building a Calculation

- What are we trying to model?

- What are the ingredients?

- How shall I lay out the calculation block?

- What are the operators I could use?

- What functions are commonly used in financial modelling?

- What Excel shortcuts can I use?

- What other FAST principles should I use to build the block?

- How can I produce a graph to show the balance?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.