Understanding The New UK and Ireland GAAP

From 1 January 2015 there will be a fundamental change in the way financial results are reported. Understand the new Financial Reporting Standards, the background to the decision to adopt them and how they were developed.

This course will enable you to

- Understand the background and history behind the decision to adopt the new regime

- Find out about the new FRSs, and their main principles and requirements

- Understand what the key dates and transition implications are

- Find out what disclosures are necessary in the first FRS102 statements

About the course

You, your organisation and your clients need to prepare for a fundamental change in the way financial results are reported. From 1 January 2015, companies who do not already follow International Financial Reporting Standards (IFRS) or Financial Reporting Standard for Smaller Entities (FRSSE), will be required to comply with new FRSs. These new standards, in particular FRS 102, will effectively replace the existing UK and RoI Generally Accepted Accounting Practice (GAAP).

In her course, Lisa Weaver helps you to understand the new regime, the background to the decision to adopt it and how it was developed. The course looks at the main principles of each of the main FRSs and enables you to think through the choices available to you so that you can start to make informed decisions about how you are going to implement the new standards before 1 Jan 2015 deadline.

Look inside

Contents

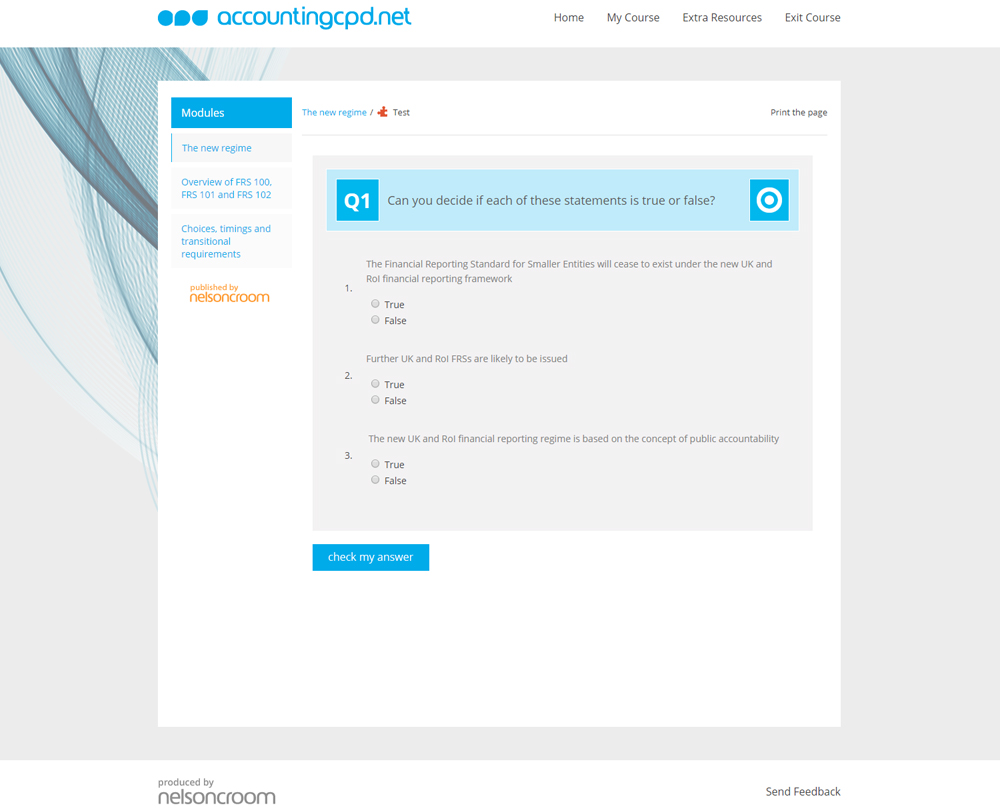

- The new regime

- Why change at all?

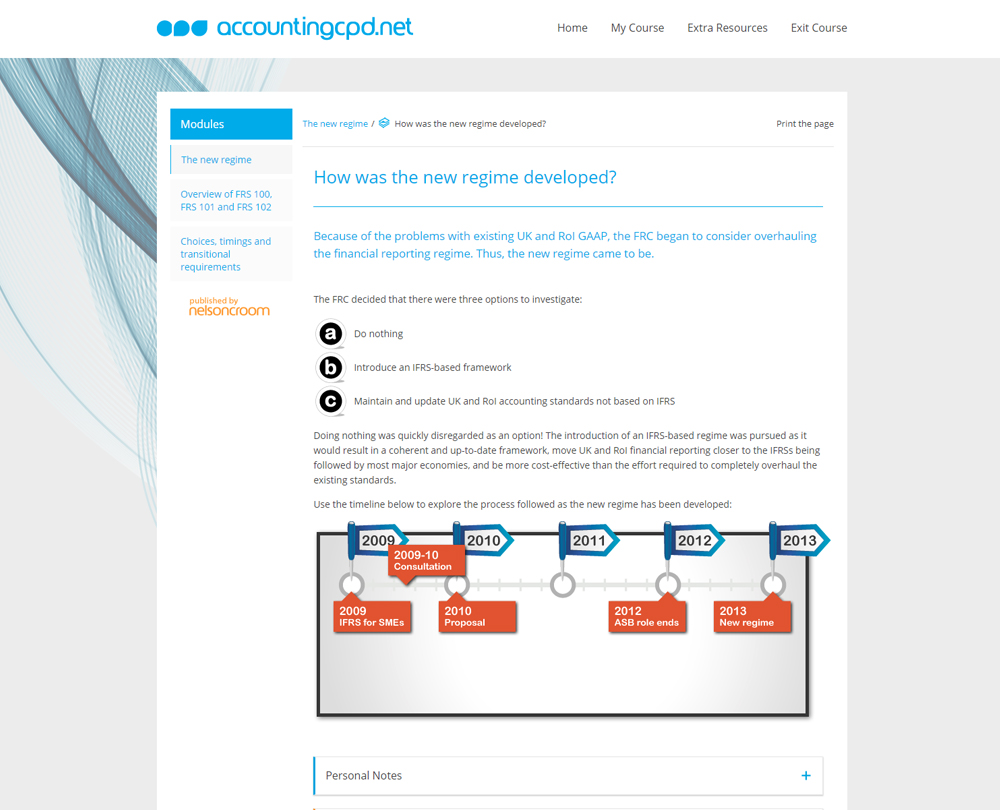

- How was the new regime developed?

- What are the new FRSs?

- Overview of FRS 100, FRS 101 and FRS 102

- How do the new FRSs relate to each other?

- What are the main principles and requirements of FRS 100?

- What are the main principles of FRS 101?

- What are the pros and cons of adopting FRS 101?

- What are the main principles of FRS 102?

- Choices, timings and transitional requirements

- Which part of the new regime should we adopt?

- When are the new standards effective and what is the transitional period?

- What adjustments are made on transition to FRS 102?

- What disclosures are necessary in the first FRS 102 financial statements?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses