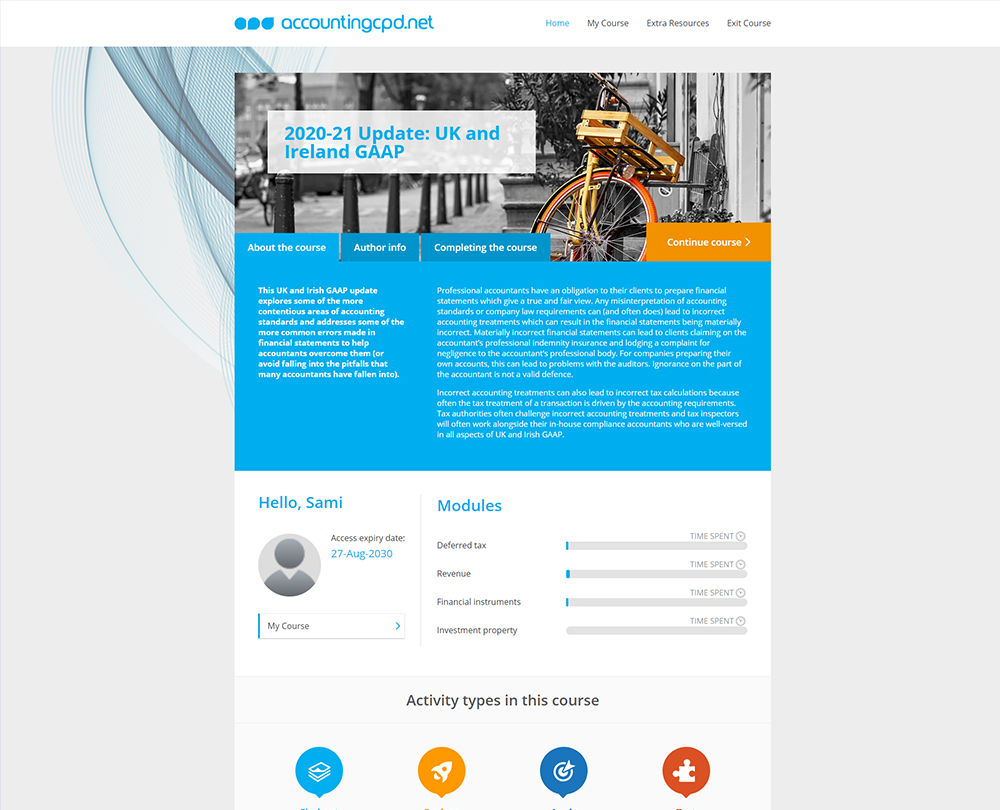

2020-21 Update: UK and Ireland GAAP

Examine some of the more common errors made in financial statements. These mistakes may be common, but they can result in financial statements that are materially incorrect, which can result in complaints of negligence and run-ins with the tax authority.

This course is not currently available

This course will enable you to

- Understand the common areas in UK and Ireland GAAP where mistakes are made and avoid them

- Ensure that the accounts you prepare present a true and fair view of the companies’ financial position

- Avoid run-ins with the tax authorities by understanding the issues surrounding deferred tax in financial statements

- Ensure that your revenue recognition policies are sound and robust so that you cannot be accused of manipulation

- Sharpen your understanding of both basic and compound financial instruments, and how to recognise them appropriately in financial statements, as detailed in Sections 11 and 12 of FRS 102

- Clarify the official definition of investment property and how and when to account for gains and losses

About the course

This year's UK and Ireland GAAP Update examines some of the more common errors made in financial statements. These mistakes may be common, but they can result in financial statements that are materially incorrect, which can result in complaints of negligence and run-ins with the tax authority.

This course will enable you to spot the potential pitfalls in revenue, where manipulation can result in unethical behaviour, in basic and compound financial instruments, investment property and fair value accounting for gains and losses, and in deferred tax and the timing of its recognition.

Look inside

Contents

- Deferred tax

- How was FRS 102 developed?

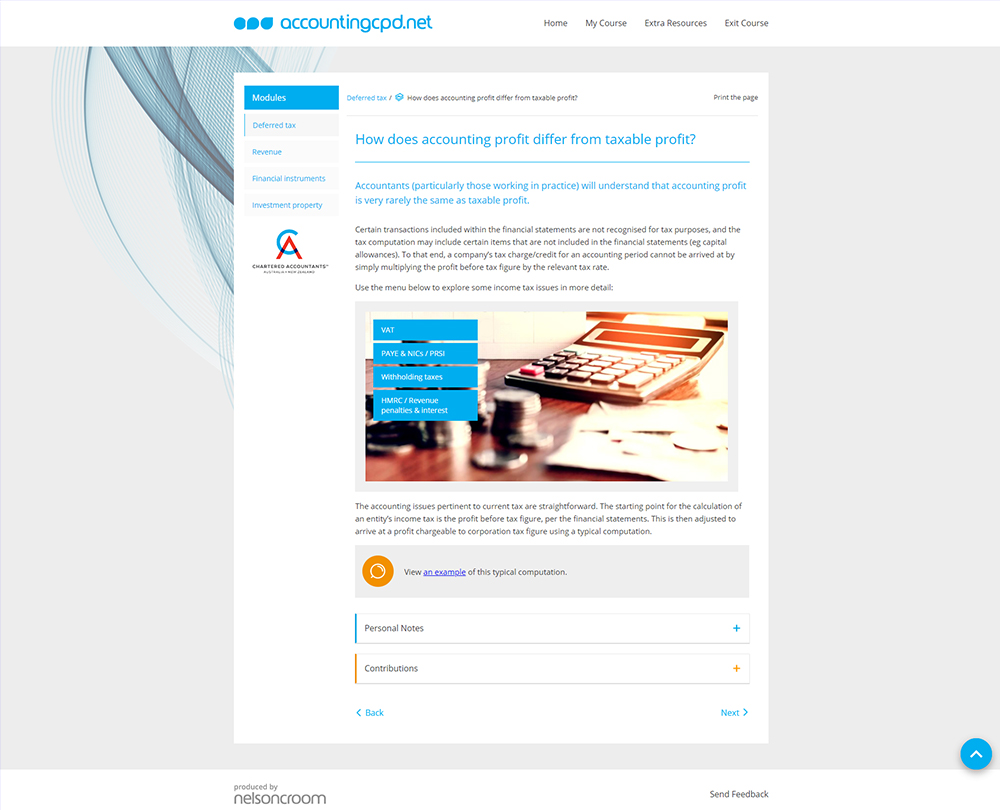

- How does accounting profit differ from taxable profit?

- Why is deferred tax recognised in the financial statements?

- How do we deal with fixed assets?

- How do we deal with fair values used in business combinations?

- How do we deal with unremitted earnings?

- What tax rates are used to calculate deferred tax?

- What are deferred tax assets?

- What are the accounting and presentation issues here?

- Revenue

- What is the difference between revenue and income?

- Where does Section 23 of FRS 102 not apply?

- How is revenue measured?

- How are deferred payment terms accounted for?

- How is an exchange of goods and services reported?

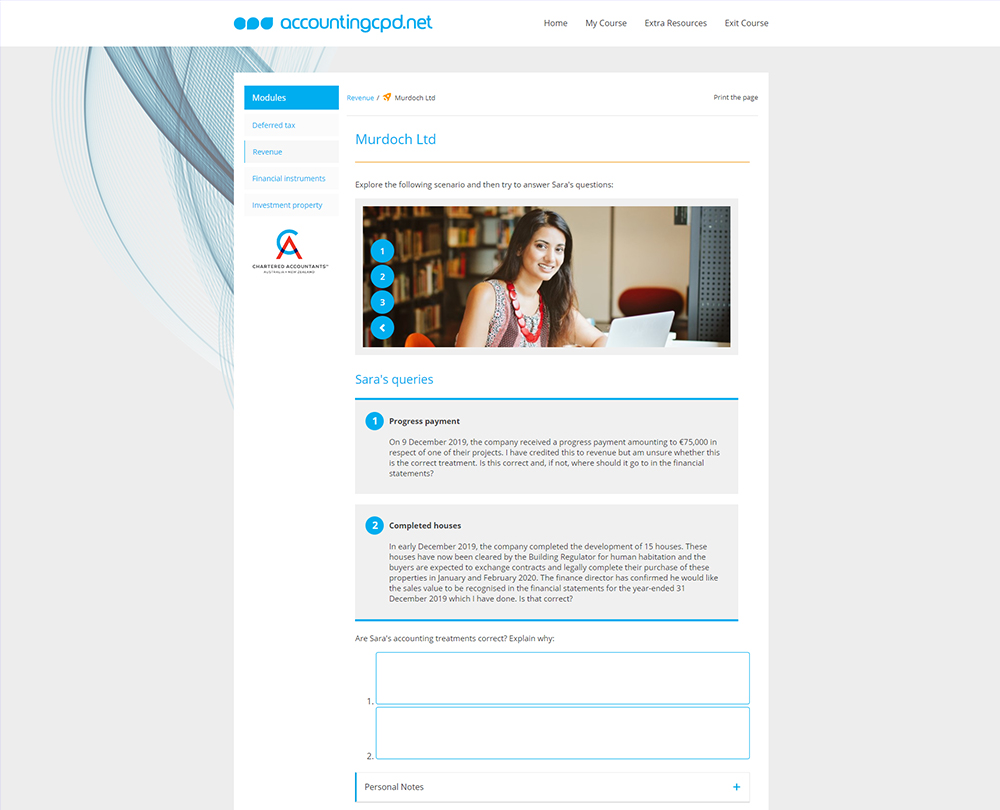

- How do we account for the sale of goods?

- How is rendering of services accounted for?

- What about construction contracts?

- When is separating contracts necessary?

- How do we account for interest, royalties and dividends?

- What do we need to know about disclosures relating to revenue?

- Financial instruments

- What is a financial instrument?

- When is a financial instrument basic?

- How is initial recognition dealt with?

- What is the amortised cost and effective interest method?

- How is impairment dealt with?

- How do we derecognise a financial liability or asset?

- How do we account for directors’ loans?

- What happens when a company becomes medium-sized?

- How do we account for compound financial instruments?

- What makes financial instruments non-basic?

- How do we deal with subsequent measurements?

- What are derivative financial instruments?

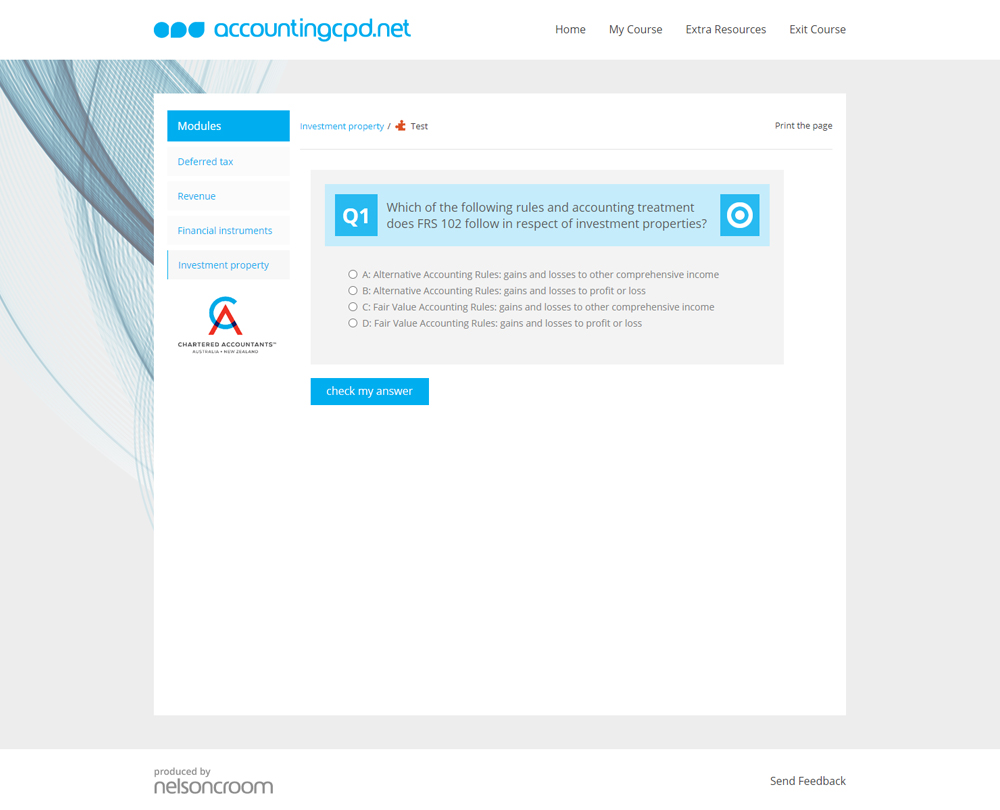

- Investment property

- What is classified as investment property?

- How are common property issues dealt with?

- How are fair value gains and losses accounted for?

- How do we deal with transfers to and from investment property?

- What is intra-group investment property?

- How do we use the cost model for intra-group investment property?

- What are the disclosure requirements?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.