2019-20 Update: Financial Reporting

It is crucial that you are aware of amendments made to accounting practices and standards for financial reporting. This course will look at what has changed as a result of the triennial review and how entities will be impacted. It will look at the latest edition of FRS 102, the types of entities that can apply FRS 105, the disclosure requirements and the restrictions.

This course will enable you to

- How the FRC intends to review UK and Irish GAAP in the future

- What has changed as a result of the FRCís triennial review, how entities will be impacted and the consequences of adopting some, or all, of the changes

- The types of entity which can apply FRS 105, the disclosure requirements and the restrictions

- The accounting issues arising from amendments in the latest edition of FRS 102

- The changes made to fair value measurement for properties

About the course

It is crucial that you are aware of amendments made to accounting practices and standards for financial reporting.

Current UK and Irish GAAP has been in existence for a few years now and was recently subjected to the first triennial review, completed in December 2017. As a result, amendments arising from the triennial review are mandatory for accounting periods commencing on or after 1 January 2019. For most businesses, this will be from the 31 December 2019 year-end.

In this course, you will look at what has changed as a result of the triennial review and how entities will be impacted.

You will also look at the types of entities that can apply FRS 105, the disclosure requirements and the restrictions. Finally, it will look at the latest edition of FRS 102, which is the March 2018 edition issued by the Financial Reporting Council (FRC).

Look inside

Contents

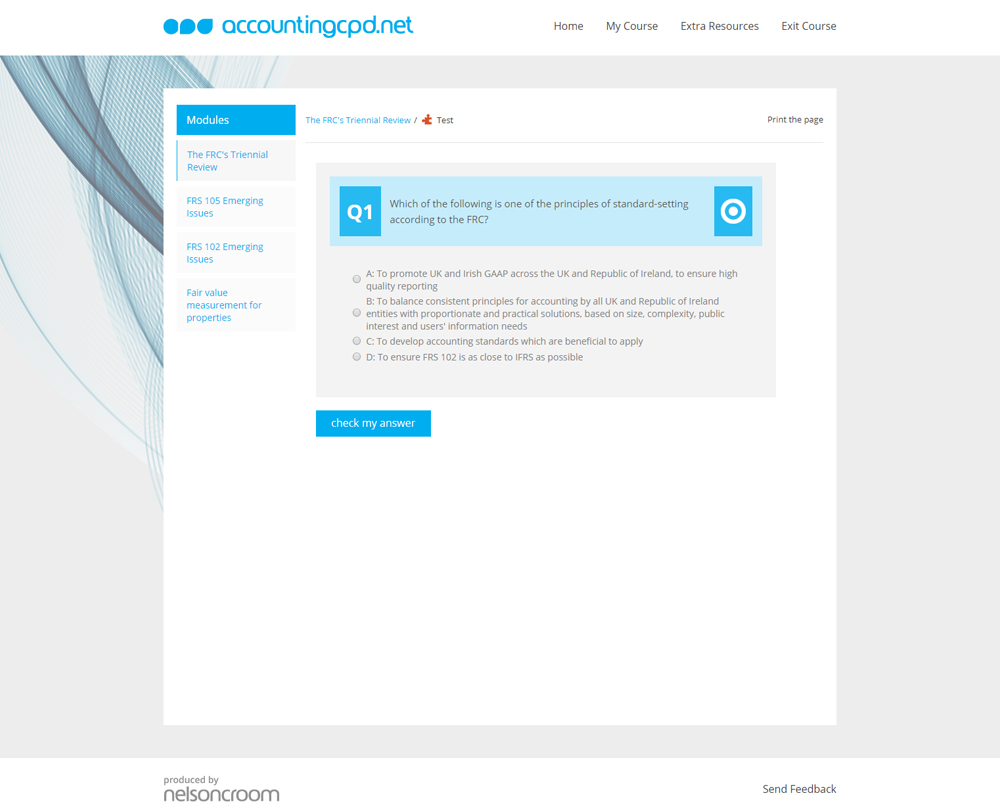

- The FRC's Triennial Review

- What is the triennial review?

- What happened to undue cost or effort exemptions?

- How are investment properties within a group treated?

- What are financial instruments?

- What are the rules for directors' loans?

- How are intangible assets recognised?

- What are the rules for small entities?

- What other changes have been made?

- How will entities be impacted by the changes?

- FRS 105 Emerging Issues

- What is the micro-entities legislation?

- Which companies qualify as a micro-entity?

- What are the differences between FRS 105 and FRS 102?

- What are the disclosure requirements under FRS 105?

- What are the mandatory disclosures for UK-based micro-entities?

- What are the mandatory disclosures for micro-entities in the Republic of Ireland?

- What restrictions are imposed by FRS 105?

- What are the rules regarding investment property?

- What are the rules for previous UK GAAP revaluation as deemed cost?

- FRS 102 Emerging Issues

- How are goodwill and intangible assets affected?

- Can you capitalise on research expenditure?

- Do you have to amortise intangible assets?

- What government grants are there?

- What is the difference between a finance and operating lease?

- Operating leases

- What are financial instruments?

- What is a bank overdraft?

- What is deferred tax?

- What is a business combination?

- What are the disclosure requirements for small entities?

- Fair value measurement for properties

- What constitutes investment property?

- How is investment property initially recognised?

- What is the subsequent measurement?

- How is investment property handled within a group?

- What are the rules for property, plant and equipment?

- How are revaluation losses dealt with?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses