2024-25 Update: UK Tax

This year will be a busy time for everyone working in tax, with plenty to get to grips with. This course provides a comprehensive overview of the recent updates made to personal, business, capital, and indirect taxation and ensures you’re well-equipped to navigate the changes.

This course will enable you to

- Quote the latest tax rates, thresholds and allowances

- Explore the complex IR35 rules and some recent case law

- Understand recent changes made to Child Benefit and the HICBC, inheritance tax, stamp duty land tax and basis periods

- Apply reliefs available for capital allowances, research and development, VAT and private residences

- Identify VAT registration and deregistration issues

About the course

Finance Act 2024 received Royal Assent last February, legislating for some of the changes contained in 2023’s Autumn Statement. The Chancellor delivered a Spring Budget in March, alongside the publication of Finance (No. 2) Bill 2024. In short, there's a lot to stay on top of from 2024!

This course will ensure you're up to speed on developments and changes impacting personal, business, capital and indirect taxation. We'll cover the key tax issues for 2024, including Child Benefit, basis period reform, full expensing, the capital gains tax regime and the VAT system.

For more recent tax updates see our quarterly Updates courses.

Look inside

Contents

- Personal tax

- Looking at personal tax

- Income tax rates and thresholds

- IR35 update

- Savings tax

- Tax efficient savings products

- Benefits-in-kind: Cars and vans

- Child Benefit and the HICBC

- Business tax

- Looking at corporate tax

- Corporation tax rates

- Basis period reform

- Capital allowances full expensing

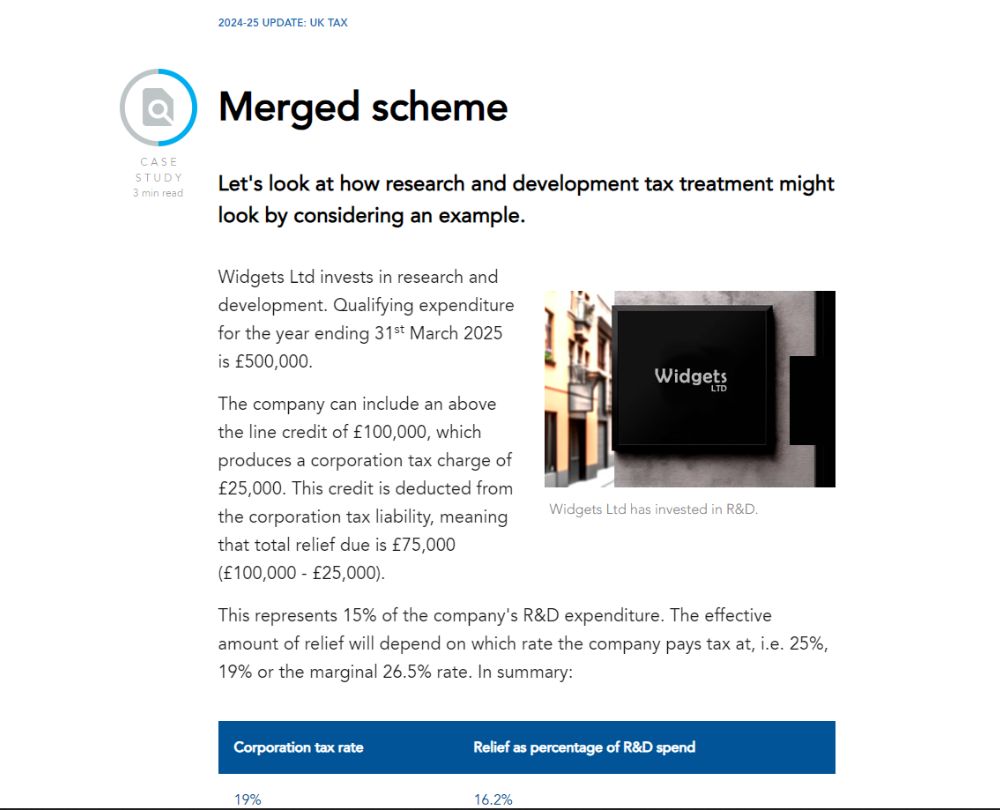

- Relief for research and development

- Capital tax

- Looking at capital tax

- Capital gains tax rates and allowances

- Annual exemption

- CGT reporting obligations

- Private residence relief

- Inheritance tax update

- Residence-based regime

- Agricultural and woodlands reliefs

- Payment of IHT and probate changes

- Non-UK domiciles tax regime

- Indirect tax

- Looking at indirect tax

- Registration and deregistration thresholds for VAT

- When to deregister

- Energy-saving materials and VAT

- Business rates

- Retail, hospitality and leisure properties

- Stamp duty land tax

How it works

Reviews

You might also like

Take a look at some of our bestselling courses