2024 Spring Update: UK Tax

Part of a series of Quarterly UK Tax Updates. This course provides comprehensive tax updates for the first three months of this year including recent legislation, consultations, tax cases and changes, along with an expert analysis of the main announcements made in the Spring Budget on March 6th.

This course will enable you to

- Digest the latest HMRC publications and news

- Explore the expansion of VAT energy-saving materials relief

- Outline the detail of new and amended tax legislation

- Consider the implications of decisions in recent employment law and VAT cases

- Explain how to claim Child Benefit online

About the course

Each quarter we bring you the very latest, comprehensive updates on tax. The course covers all the key updates from the first three months of 2024, looking at the latest from the Spring Budget, HMRC publications, and new and amended tax legislation in England, Scotland and Wales.

Specifically in this quarter, the course includes advice on making Child Benefit claims online, VAT relief for the installation of energy-saving materials, and the IR35 compliance rules. Across the three months there are also details of significant tax cases, the decisions reached at First Tier Tribunals and their implications. This quarter’s bonus module is on the Spring Budget and provides full details of all the proposed changes.

Around the UK, the course looks at the Budget Statements from the Scottish and Welsh Governments, and the proposed changes to Welsh land transaction tax.

Look inside

Contents

- January update

- January overview

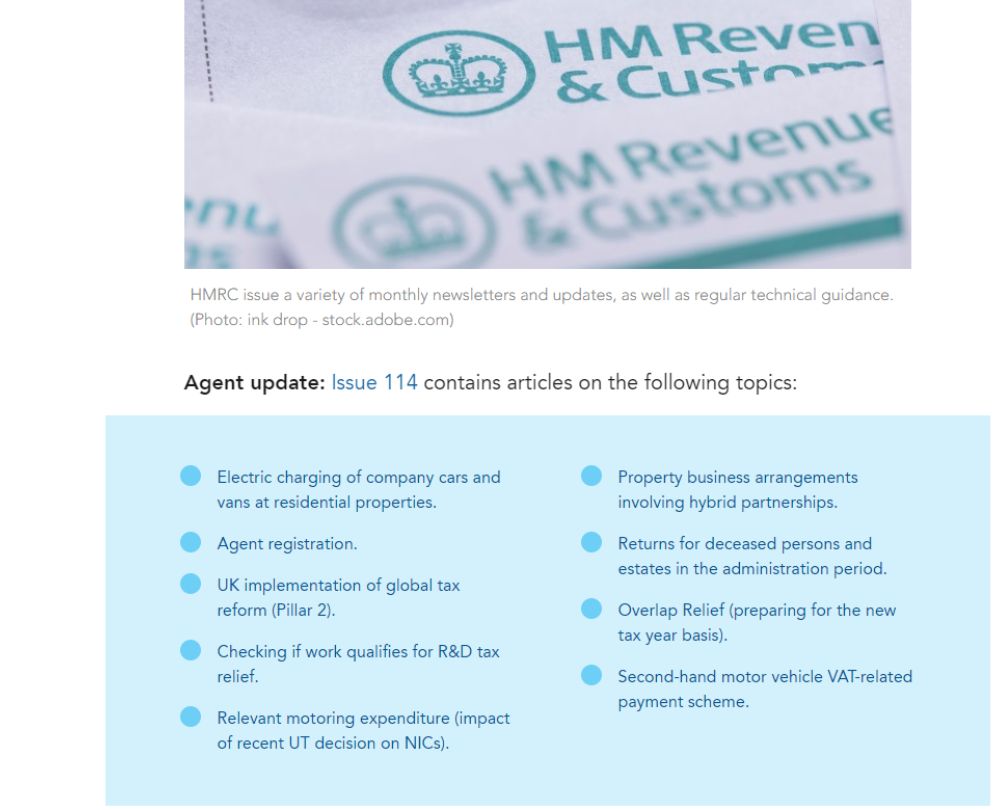

- HMRC publications

- Consultations

- Autumn Statement 2023

- Practice focus: Changes to the cash basis

- Legislation

- Key dates for January

- February update

- February overview

- HMRC publications

- Spring Budgets 2024

- Client focus: Child Benefit goes digital

- Legislation

- Key dates for February

- March update

- March overview

- HMRC publications

- Land transaction tax

- Practice focus: VAT energy-saving materials relief

- Legislation

- Key dates for March

- Spring Budget 2024

- Headlines

- Government aims

- Deep dive into property taxes

- VAT and business growth

- Other duties

How it works

Reviews

You might also like

Take a look at some of our bestselling courses