When is CPD verifiable, when is it non-verifiable, and when is it not CPD at all?

Although different professional bodies have different rules for the CPD members must complete, those that specify the number of hours that must be completed distinguish between verifiable and non-verifiable CPD:

"Members must complete x hours of CPD, y of which must be verifiable.”

Members of ACCA, Chartered Accountants Ireland, CPA Ireland, or Chartered Accountants Australia and New Zealand (CAANZ), will cast a weary eye towards the ceiling, as they are old hands at all this, but for ICAEW members grappling with the Institute’s new CPD rules that are now in full force, there is new terminology and jargon to get to grips with.

So, what makes a CPD activity verifiable or non-verifiable, and what does the distinction mean for the activities we must undertake and the records we must keep?

What qualifies as verifiable CPD?

ICAEW says that: "For a CPD activity to be verifiable there must be evidence of its completion that is:

- objective - fact based rather than based on personal perspectives;

- corroborated - can be confirmed to be accurate; and

- retained - documented and stored in an observable format.”

So, you are going to need a certificate of completion and you need not to lose it!

Note that they don’t specify the nature of the activity. They are not saying that it must be a course - just that you must be able to prove you did it.

Other professional bodies, including ACCA, Chartered Accountants Ireland, CPA Ireland, and Chartered Accountant Australia and New Zealand describe a host of different qualifying activities, and then clearly state that:

"For CPD to be verifiable, there must be objective evidence which can be proven and retained in either written or electronic form” (CAANZ)

It can be confusing that professional body regulators each have their own rules and often use different words to describe the same thing. Within an accounting practice or company finance department, there will be members of several different professional bodies and you want to be able to keep one set of records in a common format, so we have 3 simple questions which you can use to ensure that CPD is verifiable, whichever professional body you are dealing with.

Verifiable CPD checklist:

- Was it relevant to you and your work?

- Did you learn anything?

- Have you got some evidence of having properly completed it?

If the answer to all three is yes, then it is verifiable CPD.

What counts as non-verifiable CPD?

Non-verifiable CPD is CPD that is useful but difficult to prove completion. Here are two definitions.

ACCA: "General learning not related to a specific outcome or which is difficult to provide evidence for.”

ICAEW: "CPD that cannot easily be evidenced but is relevant to your role.”

The problem with this is that it downplays its importance.

Non-verifiable CPD plays a really important part in the development of accountancy professionals. For example, a major project you work on that takes you into an area you hadn’t engaged with before can be massively developmental. It’s just that it doesn’t come with a certificate.

How to record non-verifiable CPD

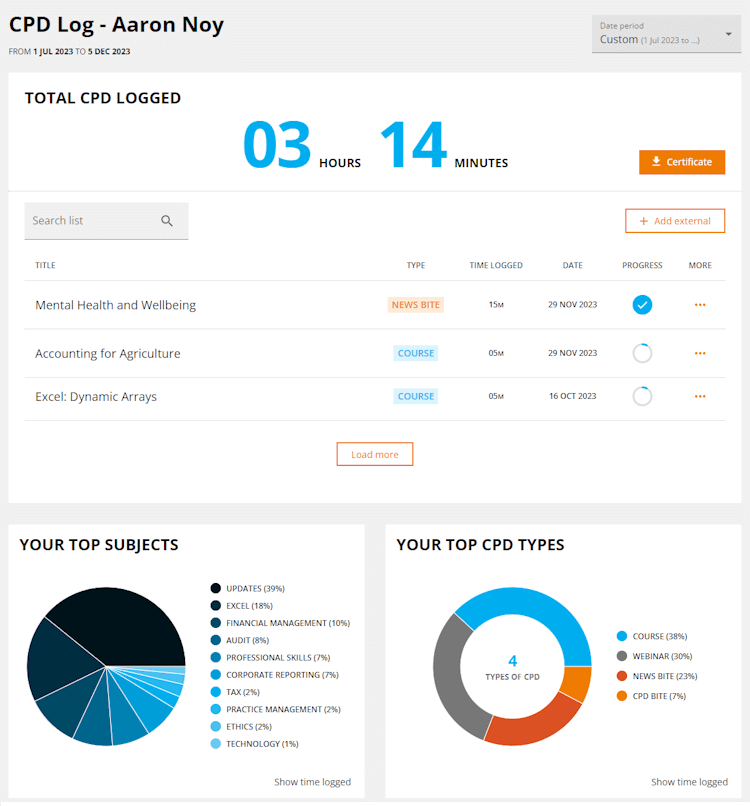

You may not have to prove completion, but you do need to keep a record of how those hours were completed, and it is good practice to make a note of what you learnt. Choose a CPD provider that allows you to store those records in the same place as your verifiable CPD so that you don’t have to go looking around in different places to retrieve it. Accountingcpd’s CPD Log allows you to upload external records so you can always have that complete record in one place.

Not CPD at all

So, what about that third category of activities that don’t even count as non-verifiable CPD? What is that? The key here is relevance. Almost all our professional body partners mention relevance or a word like it in their policy, but people often misunderstand it. If it's not relevant, it's not CPD. ‘Relevant’ does not have to be 100% accounting focused, but it does have to be relevant to your role.

It is often assumed that the point of the condition is to stop people doing a course on beekeeping and then including it in their CPD log. In fact, if you were an accountant in business, who has recently joined a company that sells beehives, a course called Apiarism for Beginners might be entirely relevant. Conversely, IFRS 9 Financial Instruments may not be.

Professional bodies are quite explicit about this. To use the words of Chartered Accountants Australia and New Zealand, "anything that does not develop or maintain your professional competence with respect to performing your role” is not allowable as either verifiable or non-verifiable CPD.

So do take that condition seriously. You may be asked to explain why something is relevant, and it is only reasonable that you should be.

And if you do find yourself working in the beekeeping industry, remember, IAS 41 Agriculture establishes the accounting treatment for biological assets during their growth, degeneration, production, and procreation. Might be worth including!

Check out our catalogue of verifiable CPD here!

You need to sign in or register before you can add a contribution.