2022-23 Update: UK & Ireland GAAP

Get up to date with the latest on UK & Ireland GAAP including deferred tax, accounting for property valuations, government grants, and liabilities and equity. Refine your knowledge of these transactions and understand the reporting requirements.

This course will enable you to

- Refresh and update your knowledge on relevant sections of UK GAAP standards, FRS 102 and FRS 105

- Get up to date with recent changes to deferred tax and know how to calculate it

- Be confident on accounting treatments for both property, plant and equipment, and investment property

- Advise on recent increases in government grants, how they are measured, categorised and the rules that apply to them

- Delve into financial instruments and how they can be financial liabilities or equity, or both

- Account for convertible debt

About the course

Preparing financial statements can be a complex task, and the frequency with which accounting standards are updated can make it even more difficult. Ensuring that you are up to date with the latest GAAP and that you have a thorough understanding of the transactions that are being handled is essential to preventing misinterpretation of your financial reports.

This course will ensure you stay right up to date with the latest information on UK & Ireland GAAP, including the complex areas of deferred tax, accounting for property valuations, government grants, and liabilities and equity. Refine your knowledge of these transactions and understand the requirements of reporting them.

Look inside

Contents

- Deferred tax update

- What is deferred tax?

- Deferred tax

- Calculating deferred tax

- The spring budget

- Super deduction

- Accounting for property valuations

- Dealing with property

- Investment property

- Mixed use property

- Initial recognition

- Leased investment property

- Subsequent measurement

- Deferred tax

- Different models

- Property, plant and equipment

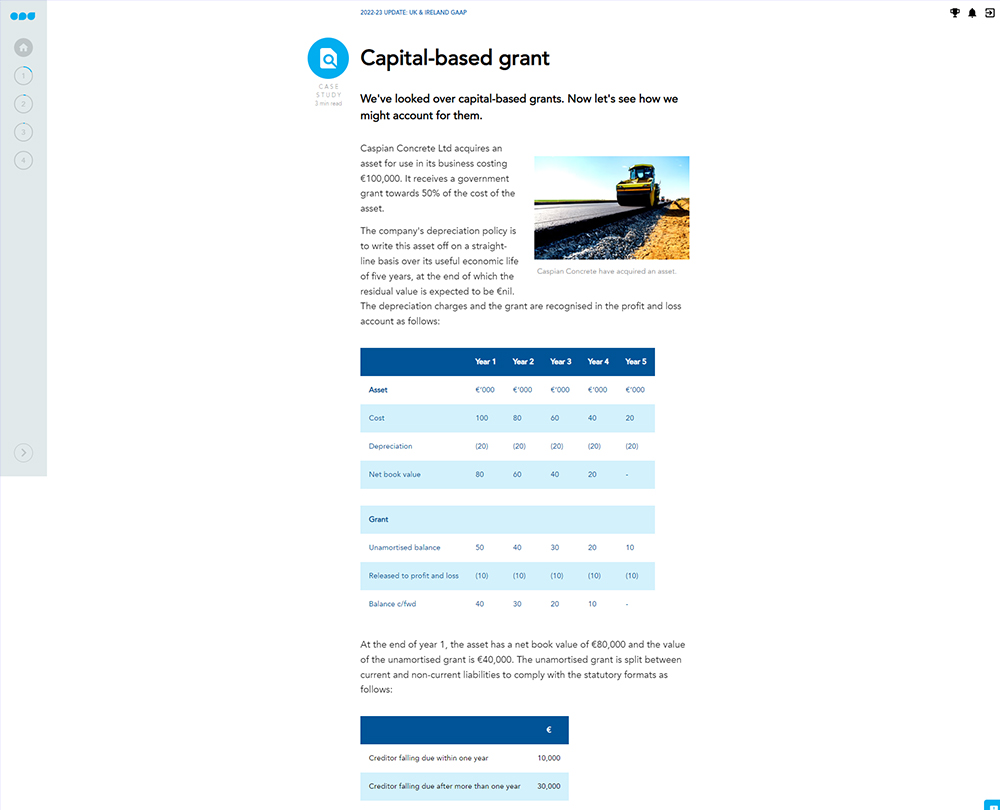

- Government grants

- Grants

- Dealing with grants

- Recognition and measurement

- Models

- Revenue- and capital-based grants

- Breaking the rules

- Repayment of grants

- Liabilities and equity

- Instrumental break

- Financial instruments

- Recognition and measurement

- Different debt

- Convertible debt

- Early redemption of a compound instrument

How it works

Reviews

You might also like

Take a look at some of our bestselling courses