2022 Update: Irish Tax

Learn about and understand all the key changes to personal, business, capital and indirect taxes. You will discover how these changes will impact yourself, your business and your clients, and how you can make sure that your knowledge and advice is up to date.

This course will enable you to

- Understand and digest the contents and implications of the Finance Act 2021

- Get to grips with key personal tax changes implemented by Finance Act 2021

- Discover updates to business taxes brought about by the Act, including measures to support the transposition of the EU Anti-Tax Avoidance Directive into Irish law

- Assess the technical amendments introduced relating to capital gains tax, capital acquisitions tax and stamp duty

- Find out more about the brand-new zoned land tax (ZLT) legislated by the Act

- Understand the changes to indirect taxes, and how they reflect the government's climate change agenda and support for businesses impacted by COVID-19

About the course

The Finance Act 2021 brought about many changes and updates to tax, including some changes that were not announced before its implementation. It is important that you are aware of these changes and so you can advise your business and clients.

Through this course, you will learn about the key changes to personal, business, capital and indirect taxes, and the legislation that brought about those changes. You will discover how these changes will impact you, your business and your clients, and how you can make sure that your knowledge and advice is up to date.

Look inside

Contents

- Personal taxes

- Personal taxes overview

- Income tax bands and credits

- Remote working relief

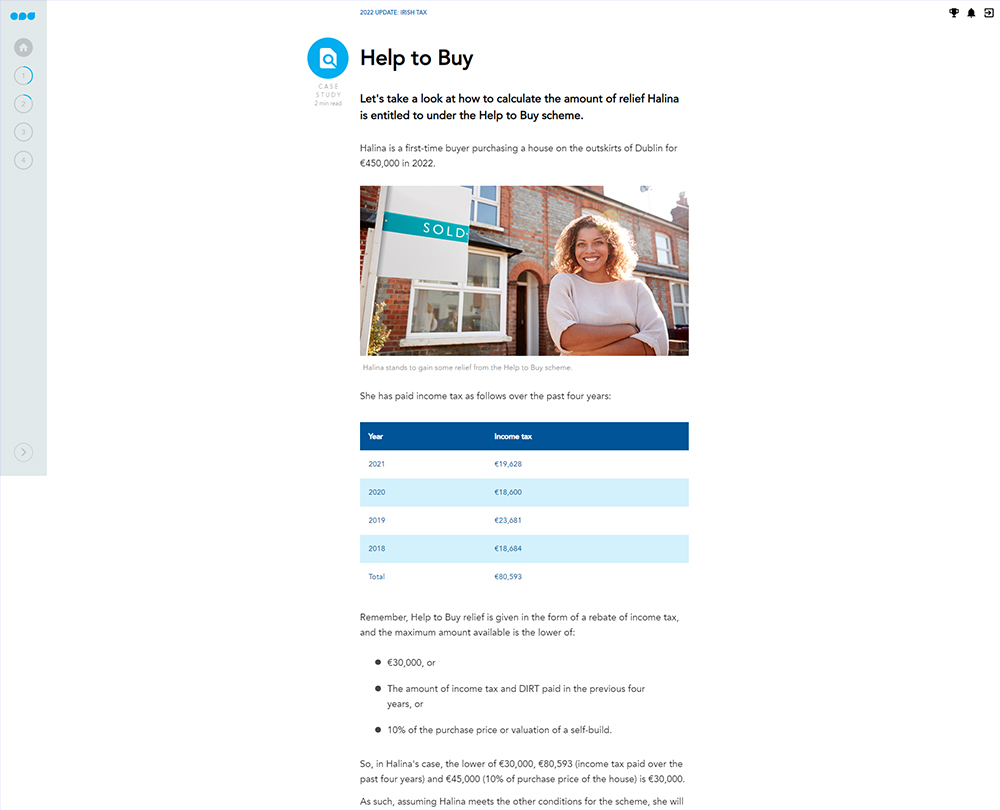

- Property-related reliefs

- Benefit in kind exemptions

- Practical steps for accountants

- Employment Investment Incentive

- Pensions

- Business taxes

- Business taxes overview

- Corporation tax

- EU Anti-Tax Avoidance Directive

- Transfer pricing

- Double tax agreements

- Employment Wage Subsidy Scheme

- Capital allowances

- CT relief for start-ups

- Dividends

- Digital gaming tax credit

- Digital gaming and transfer pricing

- Capital taxes

- Capital taxes overview

- Capital gains tax

- Capital acquisitions tax

- Property and land

- Zoned land tax

- Tax administration and Revenue

- Tax appeals

- Indirect taxes

- Indirect taxes overview

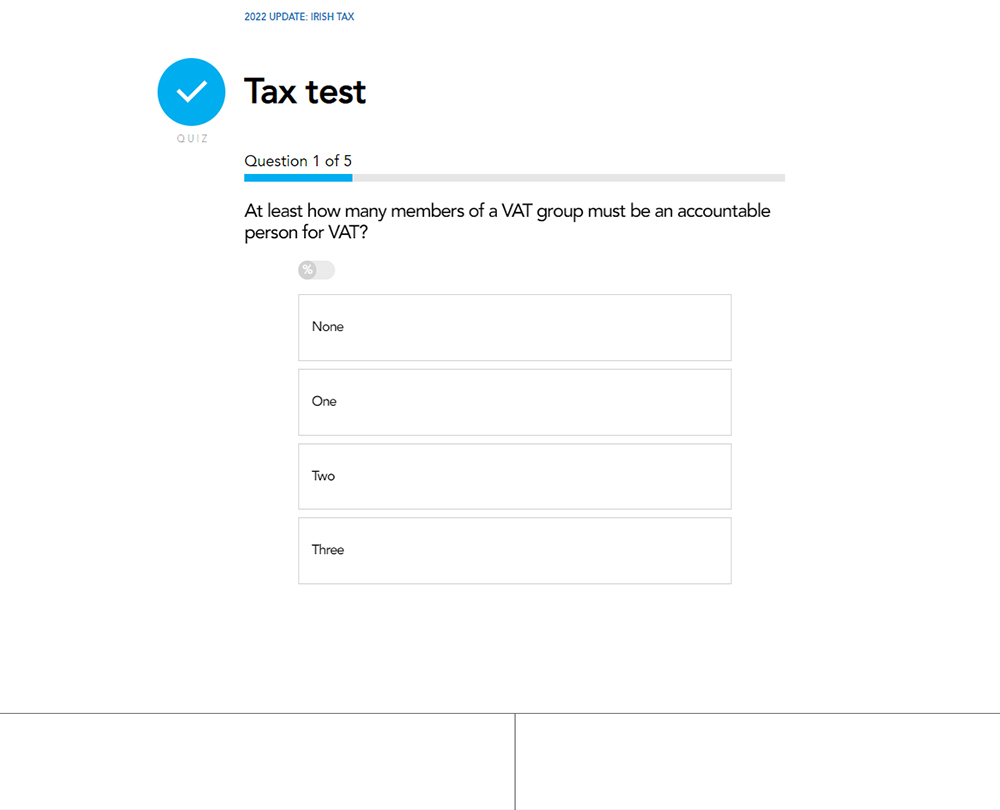

- VAT groups

- VAT treatment of cancellation deposits

- More on VAT

- Post-Brexit VAT

- Climate measures

- Excise duty

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

Got a team of 2 or more?

Develop and retain a talented finance team with our team subscriptions.

Find out moreThis course is not currently available. To find out more, please get in touch.